Grocery business

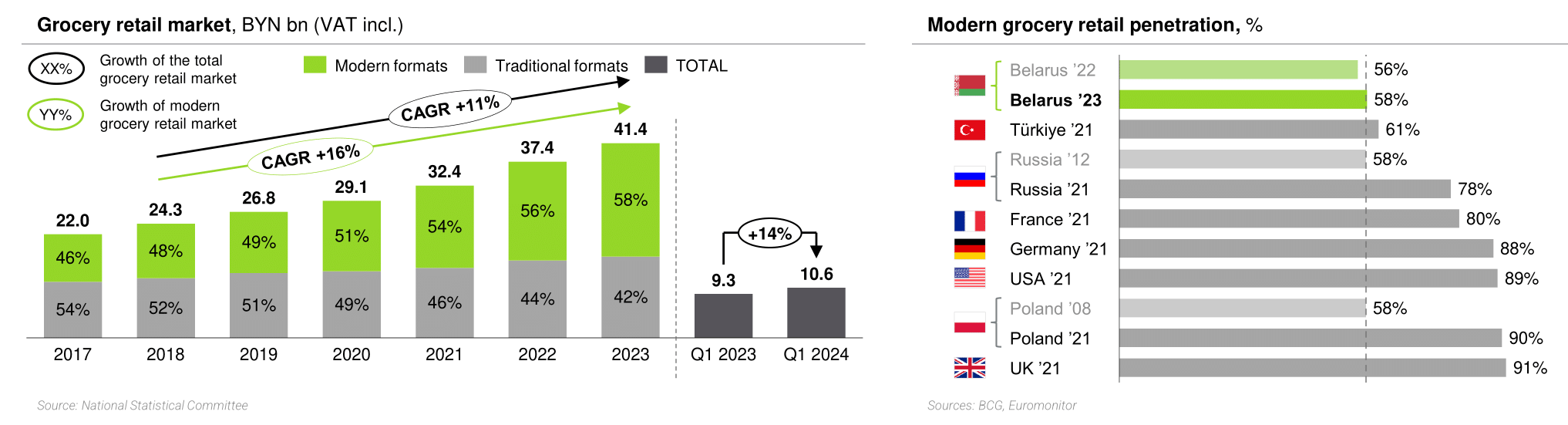

In 2023, food retail turnover in Belarus grew by 10.6% year-on-year, with real (adjusted for inflation) growth of 4.9% year-on-year.

In recent years modern grocery retail penetration has been increasing by 2 pp per year. In 2023 it reached 58% but remains structurally low compared to other emerging and developed countries. However, this signals the potential for further growth reinforced by the fact that modern retail penetration in Belarus has been sustained in recent years.

In 2023, there were no significant changes in the balance of power between the top 5 players in the market. The share of the top 5 players in the market increased by 2 pp to 42%. The market remains fragmented compared to Western countries, but in terms of concentration it is still ahead of the Russian market.

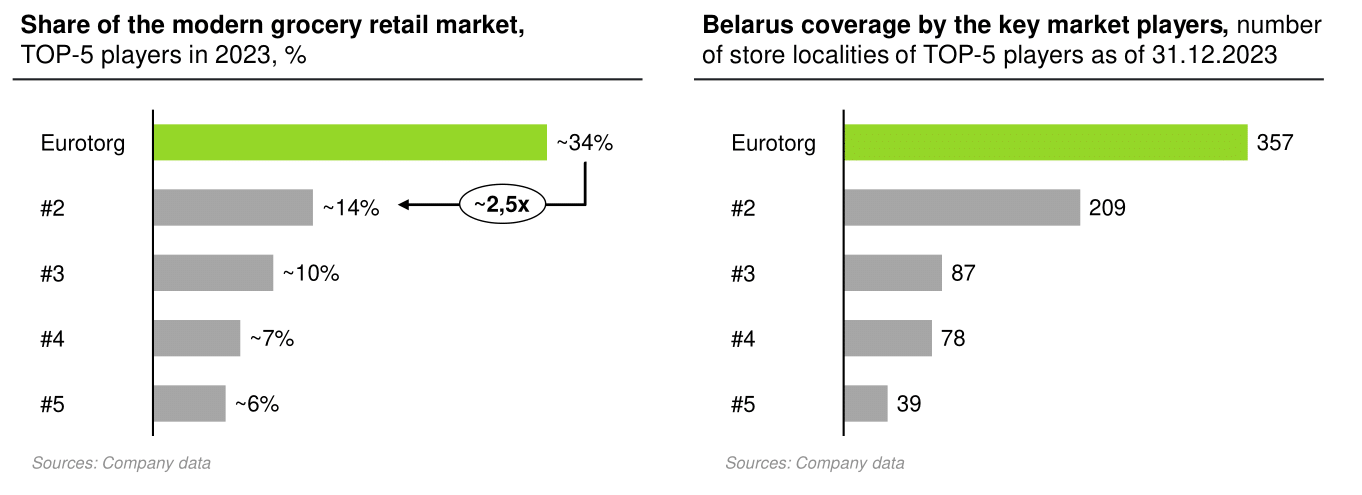

Eurotorg remains the undisputed leader in the Belarusian grocery retail market, with a market share of 20% in 2023. In the market of modern trade formats, the Company's share is ~34%, the gap with the second-large player has slightly decreased to 2.5 times but is still more than the combined market share of the next three peers. Eurotorg also has a huge advantage in terms of geographic spread, with a presence in over 180 localities where no other modern grocery retailer has a single store.

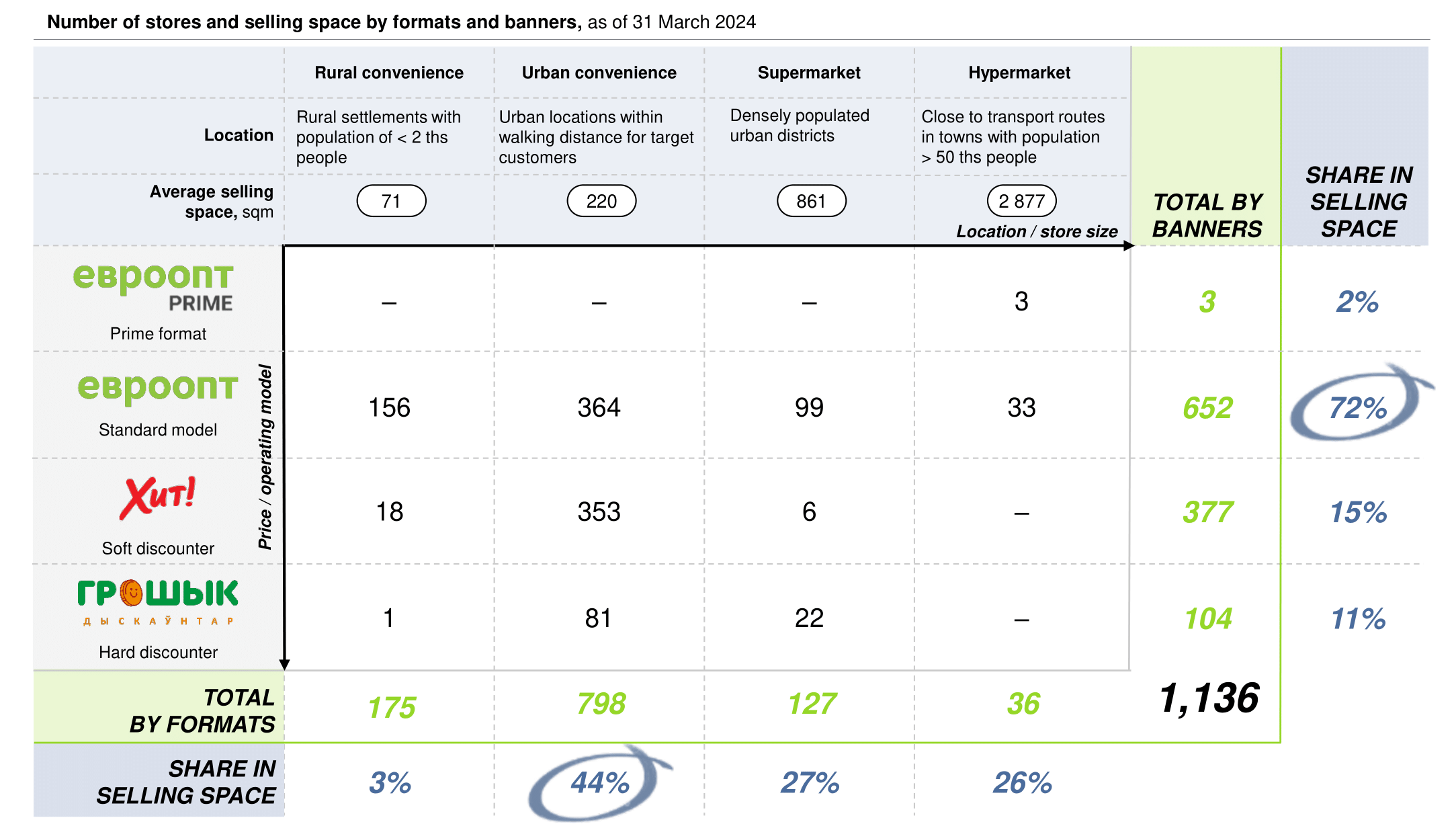

Eurotorg operates a multi-format chain: from convenience stores to supermarkets and hypermarkets under the four banners: Euroopt, Hit!, Groshyk and Euroopt Prime. Most of the stores are convenience format under the Euroopt banner. The Hit! discounter banner was launched in 2019 and the Groshyk banner in 2020, respectively. The Company deploys Prime-format stores with an extended assortment of premium brands and healthy products only in large shopping centres in Minsk.

Smaller-format stores remain key for the Company. Moreover, the retail industry as a whole is currently characterized by a trend towards the development of stores of this format.

As of the 31 March 2024, the number of urban- and rural-convenience-format stores amounted to 973, while their total share in the Company’s selling space was 47%. As of the end of 1Q 2024, convenience stores accounted for 54.9% of total net retail sales.

Keeping up with the times Eurotorg responds to the consumer demand for lower prices and focused on the expansion of discounter formats in highly competitive locations. As of 31 March 2024, the aggregate share of discounters in the Company’s selling space reached 26%, while their share in net retail sales of grocery stores was 32.3%. However, the period of discounters’ accelerated development has come to an end as the retailer is now opening them on a par with standard chain stores.

The multi-format chain model allows the Company to adapt and successfully navigate through any market changes, as well as to diversify its value proposition and provide the consumers with numerous shopping options that meet their needs, individual desires and preferences.